The Time Frame Associated With an Income Statement Is

Accounting questions and answers. A a point in time in the past.

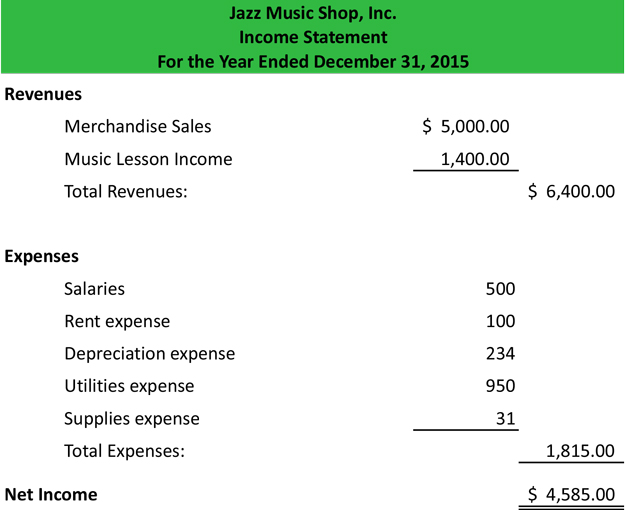

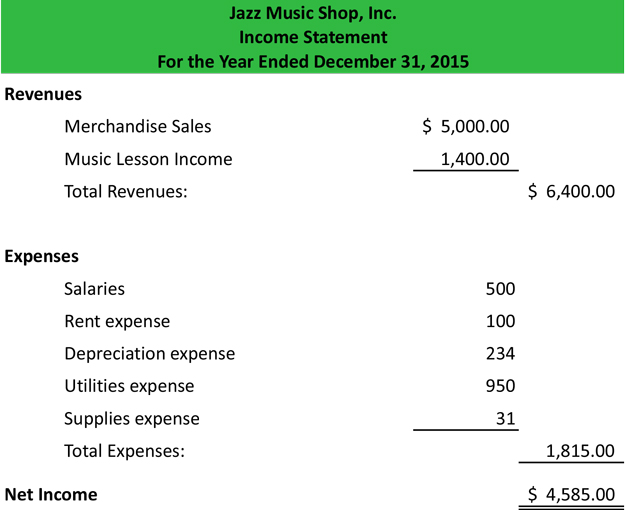

Income Statement Definition Explanation And Examples

A balance sheets heading is a point in time.

. Nine months ended September 30 2021. For example 40000 widgets purchased at a wholesale cost of 1250 each equals 500000 cost of goods sold during the period reflected on this income statement. The time frame associated with a balance sheet is.

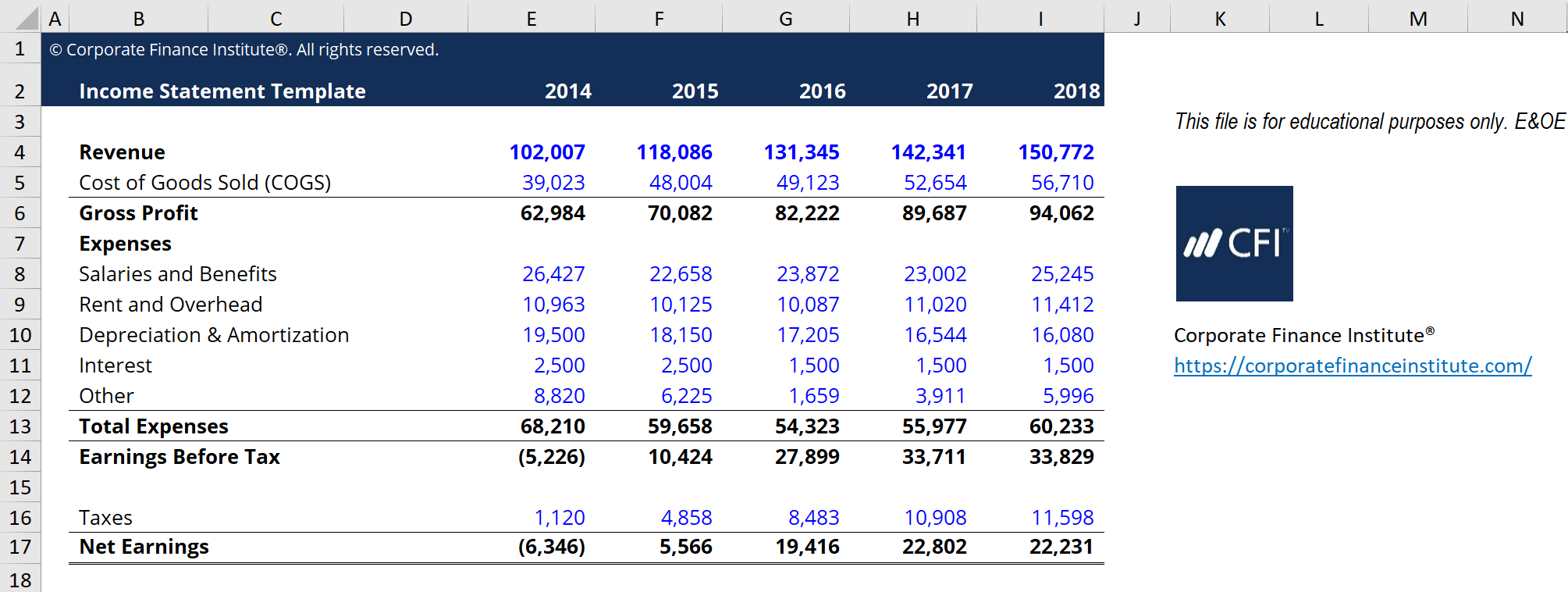

The purpose of the income statement is to show the. Thus horizontal analysis is the review of the results of multiple time periods while vertical analysis is the review of the proportion of accounts to. The income statement reports revenues expenses gains losses and the resulting net income which occurred during the accounting period shown in its heading.

Your income statement can span any time frame such as monthly quarterly biannually or even annually. - a point in time in the past. Decreases in net assets resulting from usual operating activities.

However you want your balance sheet date to end with your income statement period and the cumulative net income. Importance of time period assumption. Net income or net loss for the period covered by the statement.

From the 500000 gross profit subtract selling and administration SGA expenses. The Budgeted Income statement also known as Pro Forma Income Statement presents the forecasted financial performance of the entity for future years of operations. The income statement shows investors and management if the firm made money during the period reported.

Typical periods or time intervals covered by an income statement include. Accruals directly impact the income statement Income Statement The Income Statement is one of a companys core financial statements that shows their profit and loss over a period of time. Year ended December 31 2021.

The balance sheet date in an initial registration statement must not be more than 134 days old except that third quarter data is timely through the 45th day after the most recent fiscal year-end for all filers and except that third quarter data is timely through the 90th day after the most recent fiscal year-end for a Smaller Reporting Company if the SRC expects to report. A point in time in the past. A past period of time.

The time frame associated with an income statement is. The operating section of an income statement includes revenue and expenses. A calculation which shows the profit or loss of an accounting unit during a specific period of time providing a summary of how the profit or loss is calculated from gross revenue and expenses.

Amounts earned by a company in its main operating activities are known as __________. This is because you want your small businesss inception to be reflected on your balance sheet equity. The time frame associated with an income statement is.

The distinction between a current asset and other assets. Is based on when the asset is expected to be converted to cash or used to benefit the entity. The difference between net sales and the cost of goods sold.

This period of time might be a week a month three months five weeks or a yearJoe can choose whatever time period he deems most useful. Now that you have your income and expenses recorded on your income statement you can complete the final step which is subtracting your expenses from your revenue to. This is the correct answer.

All-Purpose Financial Statement. Transactions are summarized in. - a past period of time.

Normally an accounting period consists of a quarter six months or a year. The profit or and balance sheet of a company through the preparation of adjusting journal entries made at the end of each accounting period. Subtract the cost of goods sold from gross sales to get gross profit Line 3.

Income Statement Marilyn points out that an income statement will show how profitable Direct Delivery has been during the time interval shown in the statements heading. The time frame associated with an income statement is. Statement of Financial Position.

Typically this means that every line item on an income statement is stated as a percentage of gross sales while every line item on a balance sheet is stated as a percentage of total assets. The income statement shows a companys revenues and expenses over a specific time frame such as three months or a year. The income statement consists of revenues and expenses along with the resulting net income or loss over a period of time due to earning activities.

For a business plan the income statement should be generated on a monthly basis during the first year quarterly for the second and annually for the third. The time frame associated with an income statement is. A record of financial activity that is suitable for a variety of users to properly assess the financial health of.

An income statement lists financial. It assists the management in setting the financial target for future years designing and implementing new strategies to achieve the set financial goals and also to track the actual periodic performance. - a function of the information included in it.

The purpose of the income statement is to show the. Year ended June 30 2021. B a past period of t.

Gross profit minus operating expenses and taxes. An income statement covers the period of time shown in its heading. Add up your income.

The length of accounting period to be used for the preparation of financial statements depends on the nature and requirement of each business as well as the need of the users of financial statements. - a future period of time. A PERIOD Of Time.

Income Statement Definition Explanation And Examples

What Is An Income Statement Definition Meaning Example

:max_bytes(150000):strip_icc()/GEIncomestatementQ12020withHighlights-89082fdfdb0f4085ac6cc3123a76e322.jpg)

Comments

Post a Comment